Understanding and Working with CRA

selfology.co/TAX

ology.land/TAX

The Tax Manual

Understanding and Working

with CRA

稅務手冊

瞭解和與 CRA合作

ology.land/CRA

selfology.co/CRA

A bookmarkable page for growing our knowledge in the Canadian CRA system and finding helpful ways.

Wealthy Canadians hiding up to $240B abroad, CRA says | CBC News

Wealthy Canadians hiding up to $240B abroad, CRA says

Social Sharing

- Facebook

- LinkedIn

- Twitter

- Email

- Reddit

Latest ‘tax gap’ calculation shows lost federal revenues of up to $14.6B a year

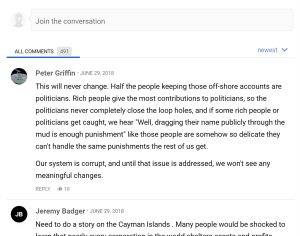

Well-heeled Canadians have hidden up to $240.5 billion in foreign accounts and are dodging up to $3 billion a year in federal tax on those funds, according to the CRA’s first ever attempt to estimate how much government revenue is lost from individuals stashing money abroad.

The Canada Revenue Agency arrived at the figure as part of its effort to calculate the country’s “tax gap” — the difference between how much the government would collect if everyone paid what they owe, and how much the government actually takes in.

“Imagine if that money was coming into productive investments in Canada building our economy,” said Diana Gibson of the advocacy group Canadians for Tax Fairness. “Imagine how many jobs you could get off of that.”

Careers at the CRA

At the CRA, our diverse workforce and inclusive workplace fosters innovation and drives us to be a world-class tax and benefit administration. We are consistently recognized as one of Canada’s top 100 employers.

Services and information

Why work with us

Find out about what the CRA offers and testimonials from our employees.

How to maintain your candidate profile

It is important to keep your candidate profile complete and up to date so that you may continue to apply to job notices and receive offers of employment.

Terms used in job posters

Definitions of key terms to simplify some of the language you will find on our job posters.

Employment equity, diversity, and inclusion

Our workforce represents a unique mix of identities, experiences and perspectives.

Integrity and service excellence

How the CRA delivers high-quality service and upholds the public interest.

CRA standardized assessment tools

List of CRA standardized assessment tools.

Putting people first at the CRA

The CRA is listening to Canadians, changing how we work, and improving services with the goal to be trusted, fair, and helpful by putting people first.

Collective agreements

Current agreements between the CRA and the Professional Institute of the Public Service of Canada and the Public Service Alliance of Canada.

Welcome veterans

Priority status, preference, and mobility questions and answers.

≡ Relative Knowledge ≡

Choosing a financial advisor

From: Financial Consumer Agency of Canada

Why work with a financial advisor

Managing your investments can be complicated. You may not be comfortable investing on your own. A professional financial advisor or planner can help.

An advisor can create a detailed financial plan, which involves:

- assessing your current situation

- determining your present and future goals and needs

- giving advice on the financial products that are right for you

- reviewing and updating your investments periodically

Choosing the right advisor depends on what help you need. If you need specialized advice, look for an advisor with expertise in that area.

Meet with several potential advisors. Ask your friends and family if there is an advisor they recommend. Choose one that you’re confident has the experience, expertise and credentials to help you reach your financial goals.

Who qualifies as a financial advisor

The terms “financial advisor” and “financial planner” are used broadly. These terms don’t always mean that a person has specific qualifications, expertise or certifications. Outside of the province of Quebec, anyone can call themselves a “financial advisor” or “financial planner.”

What sets some advisors apart from others are education, training, experience and qualifications. There are many designations for advisors. For financial planners, a type of financial advisor, there are three common designations: Certified Financial Planner, Personal Financial Planner and Registered Financial Planner. There are different requirements for each designation. Be sure to ask your financial advisor about their education so you can determine whether someone has specialized training to help you achieve your financial goals.

In Quebec, only certain trained individuals are allowed to use the title “financial planner”. The title is “planificateur financier” or the acronym “Plan. Fin.” in French.

This includes financial planners who:

- have a certificate issued by the Autorité des marchés financiers

- are members of a professional association with which the Autorité des marchés financiers has entered into an agreement.

The difference between a financial advisor and a financial planner

A financial advisor is a general term that can be applied to anybody who helps you manage your money. This could include an employee of your financial institution, a stock broker or an insurance agent.

A financial planner is a type of advisor who helps you create a plan to reach your long-term financial goals.

Some financial planners will offer you a variety of services, such as:

- help creating a budget

- identify ways you can save money on your taxes

- help planning your retirement

- provide estate planning advice

Some financial planners limit the services they offer to specific areas.

Check if a financial advisor is registered

By law, sellers of mutual funds, stocks and bonds must complete training and be registered with a provincial or territorial securities regulator.

Check if there has been any disciplinary action against a financial advisor

Look into whether an advisor or firm has been subject to disciplinary action, check for complaints or make a complaint through the following organizations:

- check on disciplinary action against a financial advisor at Investment Industry Regulatory Organization of Canada regulated firms

- make a complaint against an Investment Industry Regulatory Organization of Canada regulated individual or firm

- search the Canadian Securities Administrators disciplined persons list for names of advisors disciplined by one or more provincial securities commissions

- search for past and current enforcement hearings with the Mutual Fund Dealers Association of Canada

- check for complaints through the Better Business Bureau

- in Quebec, check for complaints with l’Autorité des marchés financiers

Paying your advisor

You pay financial advisors in different ways, depending on the type of service they provide.

For example, you may pay:

- an hourly fee to an advisor helping you create a financial plan

- a commission or a trading fee to an advisor buying a stock for you

- a percentage to an advisor based on the value of the assets they manage for you, also known as the management expense ratio

If you plan on working with an advisor, it’s important to know:

- what kind of services the advisor provides

- the cost of the services

- how the advisor is paid, such as through a commission, fee for service or salary

While most advisors aim to give good advice, some may be influenced by outside factors. For example, advisors paid by commission have an incentive to encourage you to invest where they will earn the highest commission. Those on salary may have an incentive to promote the products and services their employers offer.

Where to find a financial advisor

Where to find a financial advisor will depend on the type of advice you need.

Banks, credit unions and caisses populaires

These institutions have staff who can help you understand and buy certain types of investments, such as term deposits, guaranteed investment certificates (GICs) and mutual funds.

They can also help you start or contribute to a registered savings plan, such as a registered retirement savings plan (RRSP), registered education savings plan (RESP), registered disability savings plan (RDSP) or Tax-Free Savings Account (TFSA).

Stockbrokers and mutual fund dealers

These are licensed individuals who can help you buy or sell investments such as stocks, bonds or mutual funds.

They can also help you start or contribute to a registered savings plan, such as a registered retirement savings plan (RRSP), registered education savings plan (RESP), registered disability savings plan (RDSP) or Tax-Free Savings Account (TFSA).

Insurance companies

These companies have employees licensed to sell investment products such as mutual funds, segregated funds and annuities. Insurance companies also offer various types of insurance products.

Independent financial planning companies or consultants

These companies or consultants can offer advice, or may be registered to sell financial products. Some charge you a fee. Others are paid by the companies whose products you buy.

Questions to ask a financial advisor

Ask questions to help you decide whether a financial advisor is qualified, or if they would be a good fit to help you with your investments. Take notes and compare the responses of the different advisors you meet. Don’t feel rushed into making a decision.

Ask a financial planner about the following:

- their education and professional experience

- their certification or designation

- how long the firm they work for has been in business

- how long they have been with the firm

- if they or their firm are registered with a securities regulator

- what products and services do they offer

- how they will help you reach your goals

- if they are paid by salary, commission or other fees

- how often you’ll meet

- how they will keep you informed

- references from previous clients

- how they decide on appropriate investments for their clients

- are they licensed to sell any other products

- have they ever been disciplined by a regulator

- have there been any restrictions, terms or conditions placed on their registration approval

- are they currently under investigation by securities regulators in Canada

What type of information will my financial advisor ask for

Your financial advisor may ask for the following information to create a financial plan:

- age

- total annual income

- estimated net worth

- if you have any dependents

- monthly expenses

- the amount of income tax you pay

- your investment knowledge and experience

- your investment goals

- when you will need access to money you’ve invested

- your risk tolerance

Resources on financial advisors

Advisors belong to professional groups in their industry.

The following industry groups can be good places to start searching for more information on the industry:

- FP Canada – develops, enforces and promotes standards for financial planning in Canada

- Financial Advisors Association of Canada (Advocis) – provides information on designations of financial advisors

- Institute of Advanced Financial Planners – provides certification and promotes standards for financial planning in Canada

- Investment Industry Regulatory Organization of Canada – regulators of investment dealer firms

- Mutual Fund Dealers Association of Canada – regulators of firms that sell mutual funds

- Portfolio Management Association of Canada – members include investment counsellors and portfolio managers

Related links

.

Liaison Officer service

Important notice

The COVID-19 pandemic is affecting everyone, including small businesses and self-employed individuals. While we have temporarily suspended all in-person visits and seminars for safety reasons, liaison officers (LOs) are currently available by phone or videoconference. LOs can also discuss current COVID-19 related benefits that may help you.

Please click the “Request a Liaison Officer service” button below if you would like a liaison officer to call you to schedule a phone or online visit or book a webinar.

The Canada Revenue Agency (CRA) offers a free Liaison Officer service to owners of small businesses and self-employed individuals to help them understand their business tax obligations. A visit from a Liaison Officer is 100% confidential; the information you choose to discuss with a Liaison Officer will not be shared with other areas of the CRA, or anyone else.

How can this service help you?

There are two ways that businesses or self-employed individuals can benefit from the Liaison Officer service:

- personalized visits by phone or online (videoconference)

- webinars for associations or groups

During a personalized visit, a liaison officer will:

- Answer your tax-related questions and address concerns

- Discuss common tax errors and financial benchmarks in the small business community

- Provide information on various online tools and electronic services offered by the CRA

- Provide recommendations on how to strengthen your bookkeeping system

- Discuss COVID-19 related measures, if needed

During a webinar, the liaison officer will:

- Explain common tax errors

- Demonstrate how to use financial benchmarks for relevant industries

- Provide information on the CRA’s services

- Explain general bookkeeping concepts and best practices

- Discuss COVID-19 related measures, if needed

Have you already received an invitation for a visit from a liaison officer?

- The LO service regularly sends letters to eligible taxpayers inviting them to book a visit.

- We may also call you to follow up or offer you an invitation for a visit.

- If you are concerned that the call or invitation is not legitimate, you can ask for the caller’s name, work section, and office location and tell them that you want to first verify their identity. For more information visit: Identifying CRA calls.

- If you received an invitation and want to learn more or book a visit, call the number provided on the bottom of the invitation.

Home » The CRA Flow (selfology.co/tax)

TIME TABLE

Cape Breton family accused in $3.6M tax fraud case not calling any defence witnesses | CBC News

Mother and 3 daughters charged with attempting to defraud the federal government in elaborate scheme

Cape Breton women behind massive tax fraud handed prison terms | CBC News

4 women and 10 companies under their control claimed $56 million in sales

≡ Relative Knowledge ≡

Home » The CRA Flow (selfology.co/tax)

Bookmarkable

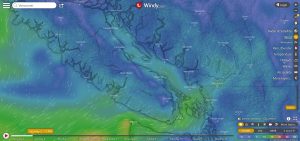

Charting the Canadian Landscape: Small Businesses, Immigration, and the 45th Federal Election

Visit Page

Charting the Canadian Landscape: Small Businesses, Immigration, and the 45th Federal Election

Visit PageMetro Vancouver Incinerator Health Alarm & River District Energy Cost Implications

Independent tests commissioned by CAPE‑BC detected toxic equivalency of 44 pg/g of dioxins and furans in

Market Dynamics Through the Lens of Primate Behavior and Government Influence

Even in the animal kingdom, behaviors emerge that seem to defy strict logical utility yet

Banksters, Bankruptcy Loopholes and Beyond: Unpacking Canada’s Financial Maze

This article delves into the complexities of the Canadian financial and legal systems, from unethical