Year of Renewal 2024 革新年

2024 Year of Renewal 革新年

Robbing Millions

The Canada Revenue Agency (CRA) admits to paying out $63 million in “sham” tax refunds to Iris Technologies, a company involved in a carousel scheme. The scheme exploited Canada’s outdated tax rules, allowing participants to claim illegitimate tax refunds. Deloitte dropped Iris as a client in January 2020, and the CRA released millions of dollars in tax refunds to Iris despite being in the midst of an audit. The CRA has refused to answer questions about the case and has declined to speak with The Fifth Estate. Carousel schemes involve passing goods around in a circle of companies to avoid paying sales tax and collect tax refunds. The CRA’s actions have raised concerns about the vulnerability of Canada’s tax system to fraud.

Furthermore…

You might be shocked to learn that some people have been involved in elaborate scams known as carousel schemes, which use fake business transactions to claim fraudulent tax refunds from the Canada Revenue Agency (CRA).

The Fifth Estate and Radio-Canada’s Enquête have investigated this issue and traced the money trail around the world. They have also exposed the role of KPMG, one of the biggest accounting firms in the world, in facilitating these offshore tax havens for the rich.

And do they need insider for all this Mary-Go-Around on Upstanding Canadians?

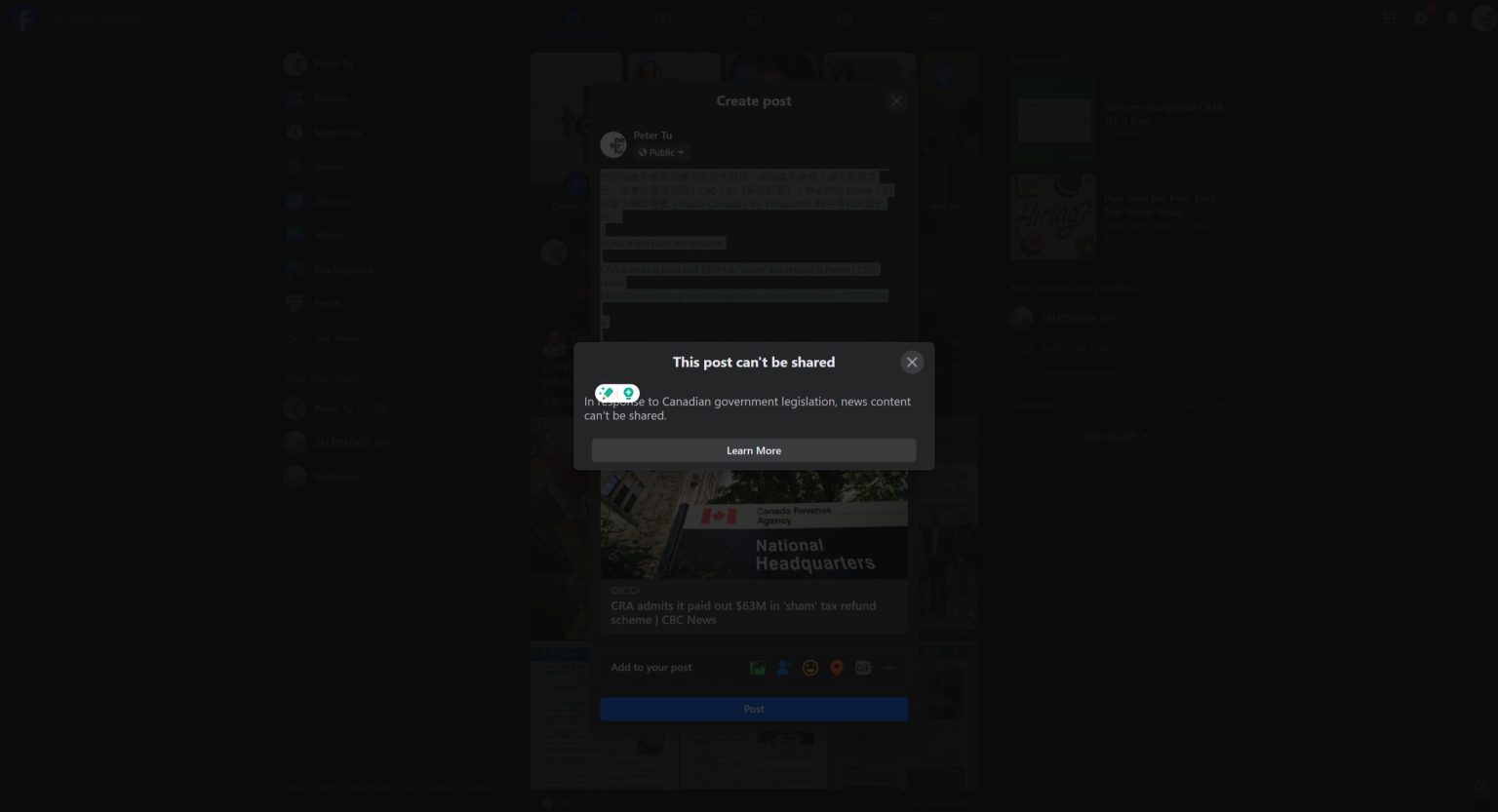

Due to Bill C-18, sharing of news is now disabled on Facebook, so I have compiled a list of links for you to watch and read. Please see the 45-minute documentary by The Fifth Estate that shows you the faces and stories of the people involved in this scandal. Do you think they are innocent or guilty? You decide.

The next time you see a crumbling community center or a lack of libraries in Vancouver, you will know part of the reason why.

See all [A] to [D], from 2016, all to way to today and the foreseeable future if you can predict the future with recent history.

[A] Who‘s robbing millions from The Bank of Canada? – The Fifth Estate – YouTube

https://www.youtube.com/watch?v=L3AqxPvmt44

https://www.cbc.ca/television/the-fifth-estate/kpmg-gold-line-telemanagement-1.7042704

https://www.cbc.ca/news/business/canada-revenue-kpmg-secret-amnesty-1.3479594

搶劫了

加拿大稅務局(CRA)承認向參與輪播計劃的Iris Technologies公司支付了6300萬美元的「虛假」退稅。該計劃利用了加拿大過時的稅收規則,允許參與者申請非法退稅。德勤於 2020 年 1 月放棄了 Iris 作為客戶,儘管正在審計中,但 CRA 仍向 Iris 發放了數百萬美元的退稅。CRA拒絕回答有關此案的問題,並拒絕與The Fifth Estate交談。旋轉木馬計劃涉及在公司圈子中傳遞貨物,以避免繳納銷售稅並收取退稅。CRA的行動引發了人們對加拿大稅收制度容易受到欺詐的擔憂。

1. 2020年1月,德勤對Iris Technologies採取了哪些行動?

2. 什麼是輪播方案,它們是如何工作的?

3. 為什麼CRA在審計期間向Iris發放了數百萬美元的退稅?

您可能會震驚地發現,有些人參與了被稱為輪播計劃的精心策劃的騙局,這些騙局使用虛假的商業交易向加拿大稅務局 (CRA) 申請欺詐性退稅。

這些計劃使加拿大納稅人損失了數億美元。

The Fifth Estate 和 Radio-Canada 的 Enquête 已經調查了這個問題,並追蹤了世界各地的資金蹤跡。他們還揭露了世界上最大的會計師事務所之一畢馬威會計師事務所(KPMG)在為富人提供這些離岸避稅天堂方面的作用。

他們是否需要所有這些關於正直加拿大人的瑪麗四處走動的內幕?

由於 C-18 法案,現在在 Facebook 上禁止分享新聞,因此我編製了一份連結清單供您觀看和閱讀。請觀看 The Fifth Estate 的 45 分鐘紀錄片,該紀錄片向您展示了參與這起醜聞的人的面孔和故事。你認為他們是無辜的還是有罪的?由您決定。

下次當你看到一個搖搖欲墜的社區中心或溫哥華缺乏圖書館時,你就會知道部分原因。

https://www.youtube.com/watch?v=L3AqxPvmt44

https://www.cbc.ca/television/the-fifth-estate/kpmg-gold-line-telemanagement-1.7042704

https://www.cbc.ca/news/business/canada-revenue-kpmg-secret-amnesty-1.3479594

We’re thrilled to share incredible news – Selfology has found and settled into a new perfect home at Granville and 41st Park Square, marking a triumphant journey through the unique challenges of the pandemic “Yesteryears” from 2020 to 2023. Your unwavering support and loyalty have made this possible.

Come visit our sanctuary at Granville & 41st, where an array of self-care experiences await. When you arrive at our Selfology haven, peaceful and spirited people will ensure your visit is truly transformational.

selfology.co/Botox selfology.co/Botox Botox & Filler Injection

Aesthetics can profoundly impact your well-being by