Enforcement Notification – West Vancouver businessman fined and sentenced to 29 months in jail for tax evasion Français

SHARE THIS ARTICLE

VANCOUVER, BC, Feb. 26, 2021 /CNW/ – The Canada Revenue Agency (CRA) announced that, on February 24, 2021, Michael Curt Helmut Scholz, of West Vancouver, was sentenced to 29 months in jail and fined $644,975.71. On June 18, 2020, Mr. Scholz was found guilty of three counts of committing tax-related offences under the Excise Tax Act and two counts of uttering forged documents under the Criminal Code, in the Provincial Court of British Columbia (Robson Square).

A CRA investigation revealed that Mr. Scholz submitted forged documents to obtain benefits relating to the construction of a West Vancouver home. Mr. Scholz forged a bare trust agreement to conceal the property’s true ownership and to support his claim of ineligible input tax credits related to the costs for the residence’s construction and design. Mr. Scholz also forged a lease agreement to decrease the CRA’s assessed value of the property in an attempt to reduce taxes owed.

All case-specific information above was obtained from the court records.

Tax evasion is a crime. Falsifying records and claims, wilfully not reporting income, or inflating expenses can lead to criminal charges, prosecution, jail time, and a criminal record. From April 1, 2019, to March 31, 2020, there were 32 convictions, with 13 taxpayers sent to jail for a total of 18.5 years. These individuals were sentenced for wilfully evading payment of $7,427,090 in tax.

The CRA remains dedicated to maintaining the integrity of Canada’s tax system, as well as the social and economic well-being of Canadians during these unprecedented times. The CRA continues to aggressively pursue tax evasion and false claims with all tools available to them. The CRA is continuously working towards making sure that individuals and businesses claim income earned, eligible losses, and benefits to which they are entitled, so that important benefit programs can be administered to those who need them. As a result of COVID-19, we are seeing the increased importance of these benefits, and are working to make sure that they continue to be available to Canadians. Any individual or business who underreports income, or claims losses or benefits to which they are not entitled, including ineligible claims for COVID-19 benefits, may have to repay the benefit amounts and may be subject to other possible action.

The CRA has set up a free subscription service to help Canadians stay current on the CRA’s enforcement efforts.

Associated Links

Leads Program

Voluntary Disclosures Program

Stay connected

- Follow the CRA on Facebook

- Follow the CRA on Twitter – @CanRevAgency

- Follow the CRA on LinkedIn

- Subscribe to a CRA electronic mailing list

- Add our RSS feeds to your feed reader

- You can also watch our tax-related videos on YouTube

SOURCE Canada Revenue Agency

For further information: Media Relations – Regional contact, Cheryl Yeung, Canada Revenue Agency, 604-666-9261

Related Links

Organization Profile

Related Organization(s)

Related

Home » Enforcement Notification – West Vancouver businessman fined and sentenced to 29 months in jail for tax evasion

TIME TABLE

On What Matters

Bookmarkable

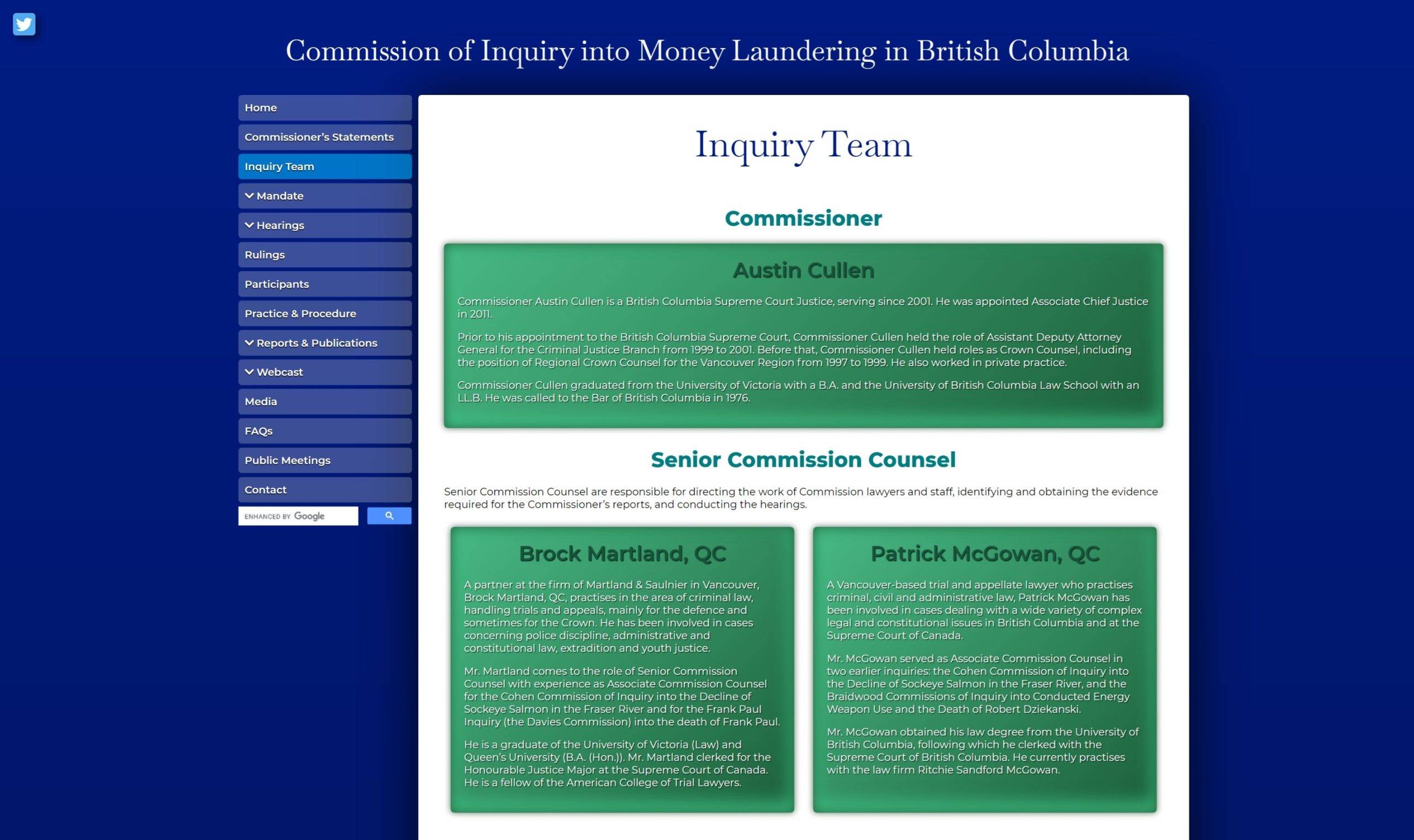

The Commission is committed to continuing with its important work for the

has the charisma of not being charismatic has the charisma of not

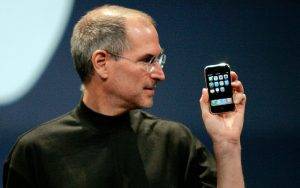

Guiding Words in Steve Jobs’ Mind Leading to the Advent of the

Table of Contents The outsourcing challenge Organizing workers across fragmented production networks

達芙妮·布拉姆漢姆:溫哥華市長利用開發商為連任提供資金|溫哥華太陽報

Pierre Poilievre has the charisma of not being charismatic What can account

What can account for this phenomenon? Click Here Table of Contents Bank